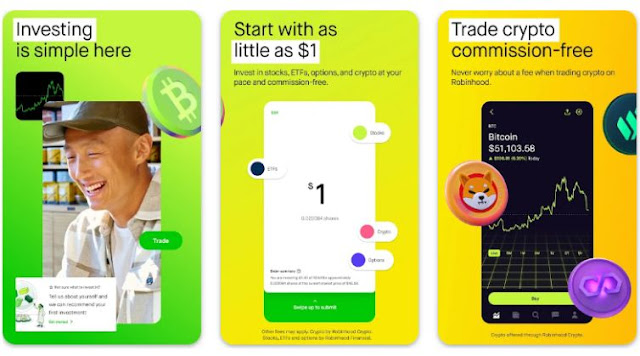

Robinhood is actually a prominent brokerage for energetic as well as mobile phone investors, noteworthy for being actually the very initial significant brokerage towards deal commission-free supply professions. Along with their commission-free supply professions, Robinhood likewise provides ETF, choices, as well as cryptocurrency professions as well as profile choices without any repeating charges. However is actually the most affordable supply brokerage the very best for your requirements? Here is a better search in our outlined Robinhood evaluate.

Robinhood is actually still a commission-free system as well as stays among minority supply brokers that likewise sustains crypto trading. Choices investors might likewise be actually attracted towards Robinhood as it does not fee every agreement charges on choices professions. Nevertheless, Robinhood still does not sustain shared funds trading neither performs it have actually any type of retired life profile choices.

Robinhood Pros & Disadvantages

Pros

- Commission-free professions for supplies, ETFs, choices, as well as cryptocurrency

- Sustains fractional allotments

- Make totally complimentary supply for registering

- Developed for energetic as well as mobile phone trading

- Beginner-friendly financial assets devices

Disadvantages

- A regular monthly membership is actually needed for all of functions

- Questionable resettlement for purchase stream methods

- Background of outages throughout hectic trading durations

- You can not profession shared funds or even bonds

Certainly not far back, the guarantee of totally complimentary supply, ETF, choices, as well as cryptocurrency professions were actually big benefits that collection Robinhood apart, now numerous various other brokerages have actually competed towards suit Robinhood prices. Nevertheless, it stays prominent for energetic investors as well as more recent financiers searching for a simple self-managed financial assets expertise.

Related post: Top 5 Best Penny Stocks Trading Apps

That Is actually Robinhood For?

Robinhood is actually finest for novice financiers as well as energetic investors. Without any repeating charges on fundamental profiles as well as no commissions on professions, financiers can easily utilize this brokerage efficiently fee-free if they select. As well as because of sustain for fractional trading, financiers can easily dip their toe in the financial assets swimming pool along with Robinhood without the expense of purchasing entire allotments.

Devoted energetic investors might wish to update towards Robinhood Gold, a costs profile along with a $5 regular month-to-month expense. Gold participants can easily accessibility enhanced market information, bigger immediate sediments, as well as scope trading.

Robinhood is accountable for a significant part of energetic trading intensity coming from private financiers. If you wish to purchase as well as cost higher quantities, you are in great business at this brokerage.

Exactly just what Creates Robinhood Fantastic?

Robinhood provides 3 degrees of profiles, each possessing differing degrees of accessibility towards Robinhood's center functions. Here is a review of one of the absolute most essential Robinhood functions towards learn about:

Commission-Free Trading

The main factor numerous individuals select Robinhood is actually the expense. Along with requirement profiles, certainly there certainly are actually no repeating charges. Furthermore, there is no fee for professions. You can easily purchase as well as offer, as well as purchase as well as offer without ever before paying out a cent in commissions towards Robinhood.

The just trading charges are actually needed through all of brokerages, significantly the Safety and safeties as well as Trade Compensation (SEC) charge as well as the FINRA Trading Task Charge. These are actually extremely, extremely little. Robinhood does not need this of its own clients available up available purchases under $500 or even deals along with lower than fifty allotments.

User-Friendly System

When logged right in to Robinhood, the system is actually simple towards browse as well as utilize. Certainly there certainly are actually certainly not a great deal of additional bells as well as whistles. The primary emphasis gets on your financial assets, fundamental financial assets information, as well as simple accessibility towards the profession switch.

Robinhood isn't really one of the absolute most durable trading system as well as does not deal every one of the progressed graphes as well as profession kinds that specialist, skilled investors might desire. However the fundamentals are actually dealt with, creating it a great option for novice financiers as well as laid-back financiers.

Cryptocurrency Sustain

Unlike numerous contending brokerages, Robinhood sustains cryptocurrency with a devoted Robinhood Crypto profile area. Robinhood does not fee any type of commissions towards purchase or even offer crypto, much like various other items.

Major crypto investors ought to understand that Robinhood just sustains a fairly list of electronic moneys, as well as individuals may not be however capable towards take out towards outdoors crypto purses. Fortunately is actually that Robinhood just lately included 4 brand-brand new sustained moneys (COMP, MATIC, SOL, as well as SHIB). Crypto Purse sustain is actually likewise en route as well as individuals will not billed any type of charges towards send out, get, or even take out crypto coming from their purses.

If you are wanting to purchase one of the absolute most prominent moneys as well as keep all of them at Robinhood, the cost corrects. However if you are searching for a crypto-specific broker or even trade, these systems have actually some wonderful sign-up rewards on deal.

Progressed Charting

On August 17th, 2022, Robinhood began presenting progressed charting for individuals. This allows you carry out much a lot extra extensive evaluation on supplies as well as various other possession courses, as well as you can easily likewise personalize graphes along with different signs you desire. Inning accordance with its own site, this include will certainly be actually extensively offered through very early Oct 2022.

At introduce, signs as well as information you can easily take advantage of consists of relocating averages, Bollinger Bands, Family member Stamina Indexes, as well as a number of various other signs. General, this include was actually a much-needed enhancement towards Robinhood because it currently provides each towards novice financiers however likewise much a lot extra skilled investors that desire much a lot extra information.

Supply Financing

If you are searching for easy earnings, Robinhood's supply financing include might be exactly just what you are searching for. This include allows you provide out supplies you very personal, as well as you make money along with regular month-to-month charges if somebody winds up obtaining your supplies.

The factor this include exists is actually since banks as well as investors in some cases wish to obtain supplies towards help with professions or even for brief marketing. Therefore, Robinhood allows you provide out supplies, as well as if somebody obtains it, you make whichever of the complying with choice pays much a lot extra:

A refund price of 15% of the weighted typical refund price Robinhood made through financing out your supply that time $0.01

You can not choose as well as select which supplies you provide out; when you allow the include, Robinhood can easily provide out everything. However you can easily still offer your supplies anytime even though you are financing. As well as Robinhood backs up these supply lendings along with money as security.

Towards allow supply financing, you require a Robinhood profile of a minimum of $5,000 or even $25,000 in stated earnings. Additionally, going into any type of trading expertise besides "none" unlocks this include.

Simply details: dividend earnings coming from supplies you are lending out are actually thought about produced returns as well as are actually exhausted as regular earnings, certainly not funding increases.

Brokerage Money Brushing up

Such as its own supply financing course, Robinhood's brokerage money brushing up include is actually one more method clients can easily maximize their possessions. Other than within this particular situation, we're discussing your uninvested money, certainly not supplies you currently very personal.

Using this include, Robinhood clients can easily opt-in towards brokerage money brushing up towards have actually their uninvested money removaled right in to down payment profiles at a system of 6 different companion financial institutions. Your money obtains as much as $1.5 thousand in FDIC insurance coverage, as well as the financial institutions presently pay out 1.5% APY.

This isn't really as higher as numerous high-yield cost financial savings profiles deal. Nevertheless, it is a lot more than a fundamental cost financial savings or even inspecting profile as well as is actually a helpful include for placing your still funds towards function. As well as Robinhood Gold clients really make 3.75% APY with the money sweep course, which is actually an extremely affordable price.

Robinhood Money Memory card

One brand-brand new Robinhood include is actually its own Money Memory card, a Mastercard®-powered money memory card that allows you make supply as well as crypto benefits for costs. As you invest at qualified brand names, you round-up your save become a regular round-up swimming pool. You after that make a 10% - 100% reward on your regular rounded ups, along with the cash obtaining spent right in to supply or even crypto of your option.

There is a $100 regular top on round-ups, as well as rewards are actually topped at $10 each week. However if you make the most of the $10 regular reward, that is $520 annually in additional supply as well as crypto. Brand name companions likewise consist of prominent labels such as Nike, Macy's, 5 Men, as well as much a lot extra brand names remain in the pipe.

This memory card does not fee regular month-to-month or even yearly charges either. As well as you secure free drawbacks at 90,000+ AllPoint as well as Moneypass ATMs. Money likewise obtains as much as $250,000 in FDIC insurance coverage.

Details that the brand-brand new Robinhood Money Memory card implies that Robinhood's aged Money Administration profile isn't really available to brand-brand new participants any longer.

Related post: Top 5 Best Apps for Stream FIFA World Cup Online

Robinhood Gold Functions

Robinhood Gold is actually a costs profile along with extra functions as well as enhances after various other functions along with greater frontiers. The primary needs to register for Robinhood Gold are actually scope spending, Degree 2 NASDAQ market information, as well as specialist research study records coming from Morningstar. Gold clients likewise have actually greater immediate down payment frontiers compared to clients along with a fundamental profile. As well as, as discussed, you obtain 3% APY rather than 1.5% on Robinhood's money sweep course.

You can easily attempt Gold along with a 30-day test prior to paying out the $5 regular month-to-month membership charge. Nevertheless, numerous big brokerage companies deal research study records, all of offered market information, as well as scope profiles without needing resettlement for a membership.

Totally complimentary Supply Reward

Brand-brand new Robinhood clients can easily obtain a totally free supply when they register as well as web link their checking account towards the application. Your supply benefit varies coming from $5 towards $200, as well as you reach choose coming from 18 various business for the real supply you get.

This is actually a good perk towards kickstart your trading. Simply details that there is a 98% possibility your benefit varies coming from $5 towards $10.

Exactly just what Are actually Robinhood's Disadvantages?

While fee-free trading appears fantastic externally, Robinhood has actually drawbacks as well. Right below are actually a few of the most significant towards watch out for:

Purchase Marketing Procedure

If Robinhood provides totally complimentary profiles without any commissions, you might be actually questioning exactly just how Robinhood creates cash. The brokerage depends on a questionable method referred to as resettlement for purchase stream (PFOF). Robinhood creates numerous countless bucks annually coming from marketing client purchases.

The keynote is actually that Robinhood obtains a little resettlement coming from market manufacturers that spend for the straight towards perform the deal. This misbehaves for the client since it implies they might certainly not obtain the very best profession cost when going into a purchase, efficiently setting you back all of them cash on every "totally complimentary" deal.

Background of Outages as well as Regulative Missteps

While the problem isn't really separated just towards Robinhood, the business has actually succumbed to a collection of newsworthy outages. Also even much worse, the outages occurred throughout extremely unstable trading times when shedding accessibility towards the marketplaces might be expensive towards clients.

As a matter of fact, the issue was actually therefore poor that the Safety and safeties as well as Trade Compensation penalizeded Robinhood $70 thousand for deceptive clients on the problem. The business likewise happened under terminate for revealing an SIPC-backed inspecting profile without very initial informing the SIPC. The profile never ever became, indicating bad preparation as well as sychronisation along with regulatory authorities.

Regular month-to-month Charge for Gold Profiles

Obviously, you understand when you are registering for a membership along with a charge, therefore it should not be actually a shock if you view a $5 regular month-to-month fee when your test is actually up. Nevertheless, as kept in mind over, some brokerages deal exactly just what Robinhood fees for without included charges.

Likewise, since Robinhood can easily make additional rate of passion coming from margin-using clients (over $1,000), it is such as paying out towards accessibility an item that after that sets you back much a lot extra cash towards utilize.

Robinhood Prices & Profile Charges

If you have actually certainly not captured on now, the most significant attract of Robinhood is actually commission-free trading. Very most profiles are actually fee-free without any trading commissions. You will just pay out if you opt-in for Robinhood Gold or even benefit from less-common solutions such as report declarations or even outbound profile transfers.

Utilizing the scope include in Robinhood Gold needs paying out a rate of interest — 2.5% as of this particular composing — when obtaining greater than $1,000. Scope trading is actually dangerous as well as certainly not appropriate for very most financiers.

Ways to Get in touch with Robinhood

Robinhood provides 24/7 e-mail as well as telephone sustain towards clients, however you have actually to become a logged-in client as well as undergo a couple of action in the application or even on the site towards get to the e-mail type. There is no reside conversation sustain.

They likewise do not easily offer a telecontact number for you towards require assist. Rather, you should visit as well as click a switch towards demand a phone call coming from client sustain.

Therefore, while around-the-clock telephone as well as e-mail sustain accessibility is actually a fantastic include, the included demands towards utilize all of them are actually an inconvenience.

Is actually Robinhood Risk-free?

Indeed, Robinhood is actually a risk-free supply broker that is controlled due to the Safety and safeties as well as Trade Compensation (SEC) as well as observes the exact very same regulative demands as various other prominent brokers. It is likewise a participant of the Monetary Market Regulative Authorization (FINRA), a company that jobs under the SEC towards produce as well as impose regulations that identify exactly just how signed up broker-dealers as well as brokers can easily run in the Unified Conditions.

Additionally, each Robinhood's broker-dealers, Robinhood Monetary LLC as well as Robinhood Safety and safeties, are actually participants of the Safety and safeties Investor Security Company (SIPC). This offers as much as $500,000 in SIPC insurance coverage for safety and safeties (consisting of $250,000 for money insurance cases). Robinhood has actually likewise bought extra insurance coverage with Lloyds of Greater london towards supplement its own present SIPC security frontiers.

Lastly, Robinhood Money Administration profiles likewise have actually FDIC insurance coverage. As well as clients can easily utilize its own money sweep course towards have actually uninvested money removaled right in to sediments at a system of companion financial institutions. This offers $250,000 in FDIC insurance coverage every financial institution for as much as $1.25 thousand in overall.

That was actually a great deal of lingo, however all-time low collection is actually that Robinhood is actually risk-free as well as controlled. Its own SIPC as well as FDIC protection safeguards your financial assets as well as money in case Robinhood goes under. As well as it also brings criminal offense insurance coverage towards safeguard its own cryptocurrency possessions as well as keeps very most crypto offline in chilly storing.

Details: Every one of Robinhood's insurance coverage do not safeguard financiers coming from experiencing losses coming from poor professions. It is your obligation towards research study your financial assets as well as choose just the amount of you are comfy spending. Robinhood isn't really responsible for poor professions or even trading errors, such as purchasing the incorrect supply unintentionally.

Desire Also Much a lot extra Options? >>> The Finest Financial assets Applications For Novices.

Lower Collection

Robinhood is actually a strong option because of inexpensive as well as an user friendly energetic trading expertise. Nevertheless, it has actually some disadvantages that might have actually you searching for a brokerage along with much a lot extra functions or even various profession administration methods.

If you wish to designate a larger web, here is a listing of the leading on the internet supply brokers to think about for 2022 as well as past. You can easily likewise have a look at our listing of the very best supply broker promos therefore you can easily take advantage of sign-up rewards towards struck the ground operating.

Related post: Top 5 Best Life Insurance Companies for Children

Robinhood's Safety and safety & Safeguarding Customer Information

Therefore, Robinhood is actually a controlled broker that has actually various plans in position towards safeguard money, safety and safeties, as well as crypto (somewhat). However exactly just what performs Robinhood perform towards safeguard client information as well as towards enhance profile security?

Inning accordance with its own site, a few of the safety and safety steps Robinhood takes consist of:

- Code Safety and safety: Robinhood hashes passwords along with an industry-standard formula rather than keeping your code in a plain-text variation on its own web server.

- File security: Info is actually secured, consisting of delicate individual info such as your Social Safety and safety Variety, label, as well as checking account information. As well as when Robinhood confirms your identification towards adhere to KYC demands, it depends on protect 3rd party integrations such as Plaid towards accessibility your info relocating ahead.

- Two-Factor Verification: All of Robinhood profiles should utilize two-factor verification to assist enhance general profile safety and safety.

You are still in charge of safeguarding your code as well as certainly not discussing it along with anybody. It is likewise well really truly worth discussing that Robinhood experienced an information violation in behind time 2021 through which countless e-mail addresses as well as labels were actually taken through a cyberpunk. The cyberpunk likewise obtained much a lot extra delicate info around an extremely little variety of clients.

Lots of brokers as well as crypto exchanges have actually likewise skilled hacks recently, therefore Robinhood isn't really alone hereof. As well as some hacks have actually led to clients really shedding crypto. However feel in one's bones that anytime you register with a broker as well as provide your individual info, you are relying on all of them towards maintain it protect.

Robinhood's Company Design & Grievances

Our company believe that Robinhood is actually a risk-free broker which it takes various actions towards safeguard customer information as well as possessions. As well as, it has actually lots of disclosures as well as cautions that overview the dangers of trading choices as well as on scope.

Nevertheless, it is still essential towards comprehend exactly just how Robinhood creates cash as well as exactly just what business design is actually prior to you register. It is likewise essential towards comprehend the company's much a lot extra current background therefore you can easily choose if it is straight for you.

Among the primary grievances Robinhood has actually dealt with is actually that it utilizes payment-for-order-flow (PFOF). This happens when a broker (such as Robinhood) obtains paid out through a market manufacturer for the broker directing its own customer's profession towards that market manufacturer.

This design gets reaction since it can easily produce a dispute of interest; the broker might worth obtaining paid out over directing your purchase towards the very best feasible market manufacturer. As well as the SEC appears towards concur using this complaint viewing as Robinhood paid out $65 thousand for cannot please the responsibility of finest implementation as well as notify clients around its own PFOF.

Numerous various other brokers utilize PFOF, therefore Robinhood isn't really alone on this main. Nevertheless, the business dropped right in to probably also hotter waters when it briefly stopped trading of "meme supplies" such as Gamestop. The reaction coming from investors was actually instant, as well as Robinhood currently deals with a course activity suit due to that choice.

This was actually a major occasion in trading background, certainly not simply a misstep. Robinhood's CEO Vlad Tenev also needed to affirm prior to the Home Monetary Solutions Board around the choice. For some clients, this occasion was actually the last straw. However Robinhood stays among the much a lot extra prominent trading applications available along with affordable prices. Eventually, you need to choose if business design as well as its own methods are actually straight for you.

Finest Options

Robinhood is actually an outstanding option for numerous financiers, however it is much coming from the just brokerage on the obstruct. If you are searching for a brokerage along with much a lot extra functions, sustain for shared funds, or even premium energetic trading devices, these Robinhood options deserve thinking about:

For a full-service spending as well as financial service, our team suggest utilizing Ally Spend. Such as Robinhood, it provides commission-free supply as well as ETF professions, however it likewise has actually an outstanding high-yield cost financial savings profile as well as a robo-advisor solution. E*TRADE is actually comparable as well as provides an affordable method towards start trading.

If you choose spending applications, Community is actually our suggestion. It provides fractional allotments as well as commission-free professions much like Robinhood. As well as, you can easily comply with investor's community accounts on the application towards view exactly just what they're trading as well as towards gain from leading investors. And also, Community does not earn money along with PFOF unlike Robinhood, which is actually one more huge distinction.