Besides life insurance, you also need motor insurance. It will protect you and your motor when you get into an accident. Many apps for motor insurance you can use to make motor insurance. In this article, we will recommend 9 apps for motor insurance in Indonesia.

What is motor insurance? How Does It Work?

Motor insurance is insurance for your motorcycle. You can use it for an accident, service, etc. Some companies also offer insurance when your motor is lost.

Motor insurance can protect the motor and its rider or owner. You will get some money from your insurance when your motor is lost. Also, when you get into an accident.

9 Recommended Apps For Motor Insurance

If you are interested in making motor insurance, here are some apps for motor insurance that you must try.

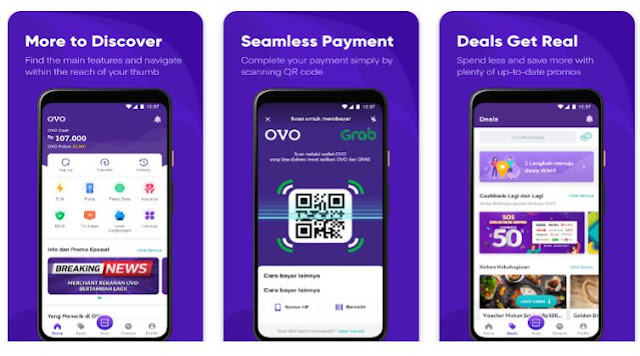

1. OVO

OVO is a digital money app. But now, they also have insurance products. They also collaborate with some life insurance companies, like Prudential, Simas, Zurich, MAG Insurance, etc. You will get easy access to make insurance for health, car, and motor.

For motor insurance, it depends on the motor’s type and year. It is available for Honda, Yamaha, Kawasaki, Suzuki, and Bajaj. Start from 15.000 – 34.000 rupiahs every month. Mostly, you can pay motor insurance every year. But in OVO, you can pay it every month.

There are some rules for your motor insurance. First, your motorcycle must be in a good condition. Second, maximum the last 10 years old motorcycle. For details, you can download it on Play Store and Appstore.

Read Also: 6 Recommended Best Life Insurance Apps

2. Motorku X

This app is developed by Astra Motor. A company of Honda Motor. This app is only used for Honda Motor customers. Motorku X is available for android and iOS. If you want to try this motor insurance app, you can download the Motorku X app on Play Store and Appstore.

From this app, you can activate and check your motor insurance. Besides that, you also can claim your motor insurance. But, don’t forget, it is only for Honda Motor users.

3. Bima+

Bima+ is the motor insurance app developed by Indosat Ooredo Hutchison and PasarPolis. They also collaborate with Jasa Raharja company. Bima+ app is available for android and iOS.

If you want to make insurance in this app, you must have a Tri SIM card that is still active. Then, you must have a driver license (SIM). Besides that, the maximum age of your motorcycle is 10 years old. The price starts from 50.000 rupiahs with a protected period of 12 month.

4. tdrive

tdrive is an app from Tugu Insurance. For motor insurance, they have a product named tride. From tdrive app, you can check and claim your tride insurance. You can claim it if your motor lost or has an accident. The price starts from 10.000 rupiahs every month.

This app is also available for Android and iOS. For android users, you can download tdrive on Play Store. For iOS users, you can download it on the Appstore.

Read Also: Life Easier with 8 Apps for Insurance

5. Qoala

Qoala is a life insurance app. This app has many types of insurance. They also have motor insurance. Qoala collaborates with some insurance companies that have motor insurance. You can compare the price with every company. Then, choose your own motor insurance.

If you want to see motor insurance in this app, you can download Qoala on Play Store and App Store.

6. JagaDiri

JagaDiri is a digital life insurance platform. They have a product named Jaga Motorku. It is for motor insurance. The price starts from 13.000 rupiahs every month.

Jaga Motorku will protect you (as an insurer) and your motor. But, it is only available for the motor with a maximum age of 9 years old. If you want to get this insurance, you can download the JagaDiri app on Play Store and AppStore.

7. Traveloka

Now, Traveloka also has motor insurance products. It is available in the Traveloka app. You can download the Traveloka app on Play Store and AppStore. You just need to fill out the form, and upload a photo of your motor. It can be used for the motor with a maximum age of 10 years.

8. Bukalapak

Bukalapak is an online marketplace for shopping. But now, they already have insurance products. One of them is motor insurance. Bukalapak motor insurance has 3 types of insurance. The price starts from 30.000 – 135.000 rupiahs.

Bukalapak insurance is available only for Indonesian citizens aged 17-70 years old. This feature is only available for minimum android users v4.60 and iOS v2.55. If you want to see it, you can download Bukalapak app on Play Store and Appstore.

Read Also: 7+ Best Apps for Insurance Broker

9. Future Ready for Grab Driver

Future Ready is a motor insurance product. This company collaborates with Grab. This product is available for Grab drivers. Grab drivers can get their motor insurance from the Grab Driver app.

This motor insurance already has permission from OJK. Besides that, it is under OJK’s control. So, you don’t need to worry about this company.

Final words

Motor insurance was like saving your money for your motorcycle and yourself. When you get in an accident, you can use it to service your motor. Besides that, you can use it for your treatment.

Before you make it, you must consider which apps for motor insurance or company you choose. You can choose it based on their benefit, rules, and price. Read every rule carefully, because each company has different rules.