One of the main fences for business owners even if they are small is having insurance. It would be better if you choose insurance that can be monitored through an application with international standards. Applications for national standard small business insurance are just in case.

Business people prefer to equip themselves and their business with applications. The reason is that insurance has many benefits, especially in the era of the pandemic which peaked in 2020 and then it is increasingly reminding that having insurance is very helpful.

For business people, it is advisable to choose an insurance application for business with international standards. This is also a preparation if one day the small business that is being built can progress to become a business with world standards.

5 Apps For Small Business Insurance

One of the businesses that really need insurance is the import-export business. Currently, the Indonesian people are literate with the international transaction process so that there are many opportunities for exporters or importers.

It is very important to choose a business insurance product that involves international transactions with international standard insurance as well. Below are recommended 5 of the best insurance apps for small businesses:

Read also: 6+ Application List For International Medical Insurance

1. MyAsei

This application is more specifically for exporters who want to be protected when making transactions. Moreover, export and import activities are very prone to damage to goods and others.

Asei is an insurance product from Indonesia but can secure small businesses that already involve foreign transactions. The advantages of the MyAsei application are that it is easy to use, full-featured and does not require a lot of storage space.

Asei's previous company name was PT Asuransi Export Indonesia. As the name implies, this insurance is more directed to the export business which causes several problems.

2. Allianz eaZy Connect

This insurance application is based in Indonesia but there are types of insurance that cover foreign businesses. The number of application installers is quite large, i.e. more than 50 thousand with more than 4 star ratings.

Another advantage of the Allianz application is the storage that is not so large. So far Allianz has received and responded to criticism of the application so that it is likely that in the future the application will be even better.

One user with the account name SE Halim gave criticism because the application was considered slow and difficult to use. Then there is also the problem of the OTP code which often fails. Allianz responded well and tried to improve the quality.

Read also: 5 Applications For Insurance Agents You Must Have!

3. My AIA SG

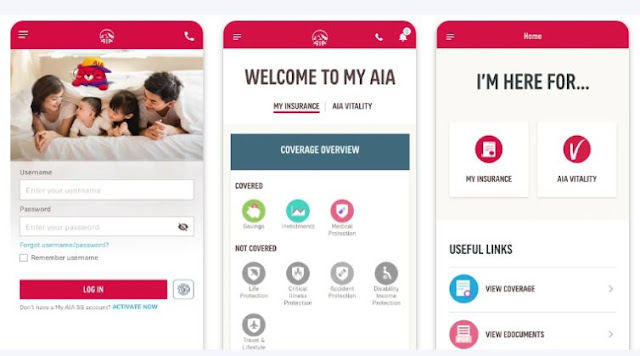

This application is more directed to health. However, AIA, which has penetrated into the Singapore area, also provides small business insurance so that it is safe for international transactions.

The advantage of this application is that it does not require large storage space. Then provide clear information about a wide selection of trusted applications. Even through this application, it can also be used directly for transactions.

Once again, the unfortunate thing about this application is that it needs a system upgrade. The reason is, the application is slower to use at certain hours.

4. Fuse PRO

This one application not only provides for business but also other insurance. Information related to insurance is very detailed and also equipped with user reviews, from this application users can find out also business insurance that can be used abroad.

The Developers show their seriousness in building applications so they are very responsive in responding to critics. The application rating is quite high, approaching five stars.

The number of application installers is also quite a lot, which is more than 50 thousand. This shows that the Indonesian people are more literate in insurance for now.

Read also: 5+ Best Insurance Application for Dogs You Need To Know!

Reasons for Choosing the Right Insurance Application

Insurance for small businesses is indeed difficult to find especially those that can reach international markets. For this reason, business people must be smart and find out detailed information regarding what applications can be used and of course can make it easier to check insurance.

Choosing insurance is the same as choosing international business protection from the start. Although business people often look down on insurance products whose purpose is to benefit both parties.

The existence of an application that can be friendly with the current smartphone will make it easier for all transactions in insurance. This includes paying premiums and seeing what products and benefits they get.

Currently in Indonesia, small business actors or MSMEs have dared to enter the international market. It is natural that insurance applications for small businesses are starting to be sought and provided, unfortunately not many insurance companies in Indonesia have reached the global market.

In addition to health, business insurance is equally important and cannot be underestimated. It will be very helpful if you want to know about insurance by reading at Ayoasuransi.com.

Insurance companies are mushrooming in Indonesia forcing buyers of insurance premiums to be selective. Do not be wrong in buying insurance so that it can be detrimental, because it is not uncommon for insurance companies to be difficult to claim, and so on.

This is also the reason insurance companies are often underestimated even though their goals are very good. Buyers of insurance premiums must be smart and selective so that they do not choose the wrong choice and the purpose of purchasing insurance can be achieved.

For this reason, applications for small business insurance on an international scale are now starting to come to mind. If this can grow rapidly, insurance companies, application developers will also be directly affected by the benefits. So there are many parties who feel the benefits and very minimal losses.